Understanding Forex Candlesticks Made Easy

Forex trading is a dynamic and exciting market where investors can make substantial profits through strategic decision-making. One of the key tools in a trader’s arsenal is understanding Forex candlesticks. In this article, we will delve into the concept of ‘forex candlesticks made easy‘ to help you grasp the essentials of this crucial aspect of trading.

The Benefits of Using Forex Candlesticks Made Easy

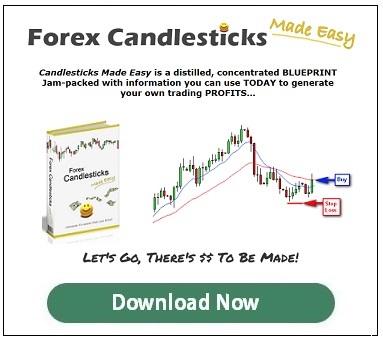

Learning how to interpret candlestick patterns can significantly enhance your trading abilities. By understanding the signals that candlesticks convey, you can make more informed decisions about when to buy or sell currencies. This can help you capitalize on market trends and minimize potential losses.

Detailed Explanation of Forex Candlesticks

Forex candlestick charts display the price movements of a currency pair over a specific period. Each candlestick represents a trading session and consists of a body and wicks. The body illustrates the opening and closing prices, while the wicks show the high and low prices during the session.

There are various types of candlestick patterns, each with its own significance. For example, a ‘doji’ signals indecision in the market, while a ‘hammer’ suggests a potential reversal. By recognizing these patterns, traders can anticipate market movements and adjust their strategies accordingly.

Frequently Asked Questions

1. What is the best way to learn forex candlesticks made easy?

The best way to familiarize yourself with Forex candlesticks is to practice analyzing different charts regularly. Additionally, there are numerous online resources, books, and courses available that can help deepen your understanding of candlestick patterns.

2. Are there any risks associated with Forex candlestick trading?

Like any form of trading, Forex candlestick analysis carries inherent risks. It is essential to combine candlestick patterns with other technical and fundamental analysis to make well-rounded trading decisions.

3. Can beginners benefit from forex candlesticks made easy?

Absolutely! Even novice traders can benefit from learning how to interpret candlestick patterns. By understanding the basics of Forex candlesticks, beginners can gain valuable insights into market behavior and improve their trading skills.

4. How reliable are the signals provided by Forex candlesticks?

While candlestick patterns can offer valuable insights, they are not foolproof indicators. It is crucial to consider other factors such as market conditions, economic data, and risk management strategies when making trading decisions.

5. Is Forex Candlesticks Made Easy suitable for day trading?

Yes, understanding candlestick patterns can be particularly beneficial for day traders. By analyzing intraday price movements using candlestick charts, day traders can identify potential entry and exit points more effectively.

Conclusion

Forex Candlesticks Made Easy is a valuable tool for traders looking to enhance their technical analysis skills and make more informed trading decisions. By mastering the art of interpreting candlestick patterns, you can gain a competitive edge in the Forex market. Remember, practice and continuous learning are key to leveraging the power of Forex candlesticks effectively.